Jerry L. Stovall, Jr.

jls@bswllp.com

Outline of Presentation Made to Lake Charles CPA Society In October 2012

PURPOSE To provide an overview of the criteria for determining whether an individual should be classified and treated as an employee or independent contractor and to review the risks that may arise from improper classification.

● ENFORCEMENT Department of Labor and Internal Revenue Service have recently announced that they plan to step up enforcement of correct categorization of employee v. independent contractor.

● WHY SHOULD YOU CARE? Costs, including taxes; Legal implications, Liability

● EMPLOYEE OR INDEPENDENT CONTRACTOR?

1) Behavioral – Right to Control – Manner in which the job is done

2) Financial Economic Realities – Does employer control business aspects of worker’s job (expense reimbursement, provide tools/supplies/insurance…)?

3) Type of Relationship – Are there written contracts or employee type benefits (pension, insurance vacation)? Will relationship continue? Is the work performed integral to employer’s business? Worker opportunity for profit/loss and ability to take other jobs.

4) “Right to Control” – Typically used by IRS for purposes of wage withholdings.

5) “Economic Realities” – Usually used for FLSA, Title VII, Age Discrimination in Employment Act, ADA and FMLA.

● IRS 20 FACTOR TEST This test helps analyze the degree of control over manner and method of work

1) Instructions

2) Training

3) Integration

4) Services rendered personally

5) Hiring, supervising and paying assistants

6) Continuing relationship

7) Set hours of work

8) Full-time required

9) Working on employer premises

10) Order or sequence set

11) Oral or written reports

12) Payment by hour, week, month

13) Payment of business and/or traveling expenses

14) Furnishing tools and materials

15) Significant investment by the worker

16) Opportunity to realize profit or loss

17) Opportunity to work for more than one business at a time

18) Making services available to the general public

19) The business’ right to discharge

20) Workers’ right to terminate

● THESE WILL NOT PROTECT YOU IF YOU MISCLASSIFY:

1) Employee wanted to be treated as an independent contractor

2) Employee signed a written contract

3) Paid only in commission

4) Has little supervision

● SECTION 530 SAFE HARBOR

1) Relief from retroactive assessment of federal tax liabilities

2) Elements: a) Taxpayer did not treat individual as an employee for any period, and b) Taxpayer is consistent with treatment of individual as not being an employee, then c) Individual will not be an employee unless taxpayer did not have a reasonable basis for not treating individual as an employee.

3) Reliance upon the following is a “reasonable basis”: a) Judicial precedent, published rulings, technical advice to taxpayer or a letter ruling to taxpayer; b) Past IRS audit of taxpayer and no assessment attributable to treatment of individuals holding substantially similar positions; or c) Long-standing recognized practice of a significant segment of the industry.

● VOLUNTARY CLASSIFICATION SETTLEMENT PROGRAM

1) September 2011

2) Provides partial relief from retroactive federal employment tax assessments for eligible employers.

3) Eligible = taxpayer consistently treated workers as non employees and filed 1099 forms for previous three (3) years.

4) Tax payer must apply for program.

5) Tax payer cannot be under audit regarding worker classification at time of audit.

6) If accepted, tax payer must pay 10% of employment tax liability on compensation paid during most recent tax year.

● COMMON WAYS EMPLOYERS ARE CAUGHT

1) Unemployment benefit claim

2) Unpaid wage claim

3) LA “Payday” Statute (La. R.S. 23:631)

4) State/Federal Charge of Discrimination/Harassment

5) State/Federal wage audit

6) Workers’ compensation claim

7) Retirement

8) DOL Audit

9) Employee complaint/suit

10) Union “drops a dime”

● CONSEQUENCES OF IMPROPER CLASSIFICATION

1) Unpaid wages (including overtime) and benefits

2) Attorney’s fees

3) Back taxes, plus interest and penalties

4) Civil fines/criminal penalties

5) Provide employee benefits, including health insurance and retirement

6) Pay any misclassified injured employees workers’ compensation benefits

7) Notice to workers (in some states)

8) Employee claims: a) Overtime b) Pay Day Statute c) Employee benefit plans d) Retirement plans e) Unemployment f) Workers’ compensation

● CASES

i) Talbert v. American Risk Inc. Co., Inc. (C.A. 5 Tex. 2010)

ii) Lindsley v. BellSouth Telecommunications, Inc. (C.A. 5 La. 2010)

iii) Hopkins v. Cornerstone America (C.A. 5 Tex. 2008)

iv) Lorentz v. Coblentz, (La. App. 1 Cir. 1992)

v) Agencies that will come knocking: (a) IRS (withholding) (b) US D.O.L. (minimum wage and overtime) (c) NLRB (employee’s right to organize) (d) EEOC (anti-discrimination laws) (e) OSHA (workplace safety) (f) State agencies

● BEST PRACTICES

1) Enter into a written agreement with independent contractor before work begins: i) Identify individual as an independent contractor ii) Set complete list of tasks to be performed iii) Specify results to be obtained iv) Do NOT require daily or weekly reports v) Do NOT specify work hours or work schedule

2) Ensure that there are differences between the way you handle employees vs. the way you handle independent contractors

3) Ensure that there is consistency between similarly-situated employees

4) Compliance check = review contracts: i) review policies ii) review jobs

5) Document agreements and duties

6) Collect documents: employer identification number, business licenses, professional licenses, insurance certificates, business cards, advertisements by contractor (yellow pages, news paper) and invoices.

● IMPORTANT LESSONS

1) “Independent Contractor” agreements do not save the day.

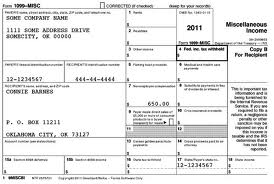

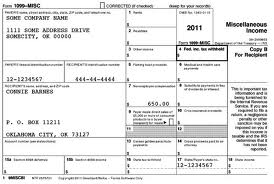

2) Issuance of a Form 1099 rather than a W-2 is not dispositive.

3) Don’t assume your classification is proper. Carefully consider statutes, applicable jurisdiction, and all facts underlying the relationship.

But where something is taken away, something is given. The credit currently permits “mounting systems” as part of eligible costs for the solar energy system credit. The regulation revision will specifically allow costs for a free-standing, ground-mounted solar energy system, which is a separate structure from the residence. The revision permits costs for the structure and its foundation that are necessary to mount the solar energy system to the specified height. The allowed structure costs do not include additional walls, interior finishes, foundations, roofing structures not directly related to the solar energy system, or any other any other addition not directly related to the solar energy system. If you’re thinking of gazebos, car/boat ports, and the like, then you see the added benefit to the revision. The LDR will hold a hearng on the proposed changes on September 27, 2012, and if there are no objections or changes, the revisions will eventually take effect.

But where something is taken away, something is given. The credit currently permits “mounting systems” as part of eligible costs for the solar energy system credit. The regulation revision will specifically allow costs for a free-standing, ground-mounted solar energy system, which is a separate structure from the residence. The revision permits costs for the structure and its foundation that are necessary to mount the solar energy system to the specified height. The allowed structure costs do not include additional walls, interior finishes, foundations, roofing structures not directly related to the solar energy system, or any other any other addition not directly related to the solar energy system. If you’re thinking of gazebos, car/boat ports, and the like, then you see the added benefit to the revision. The LDR will hold a hearng on the proposed changes on September 27, 2012, and if there are no objections or changes, the revisions will eventually take effect.